Industry Insight|2024Q1 Nutrition and Health Industry Financing Inventory: Which Directions Are Favored by Capital?

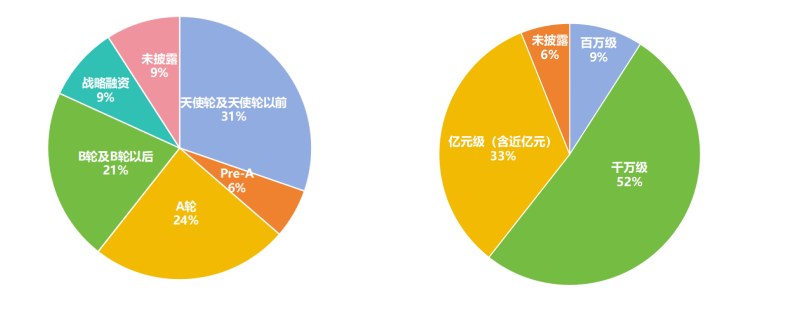

The first quarter of 2024 has come to an end, and according to the data analysis released by Zhitiqiao, we can observe that in the first quarter of 2024, there will be about 33 financing events in the global nutrition and health industry, with a total financing amount estimated to reach 1.5 billion yuan.

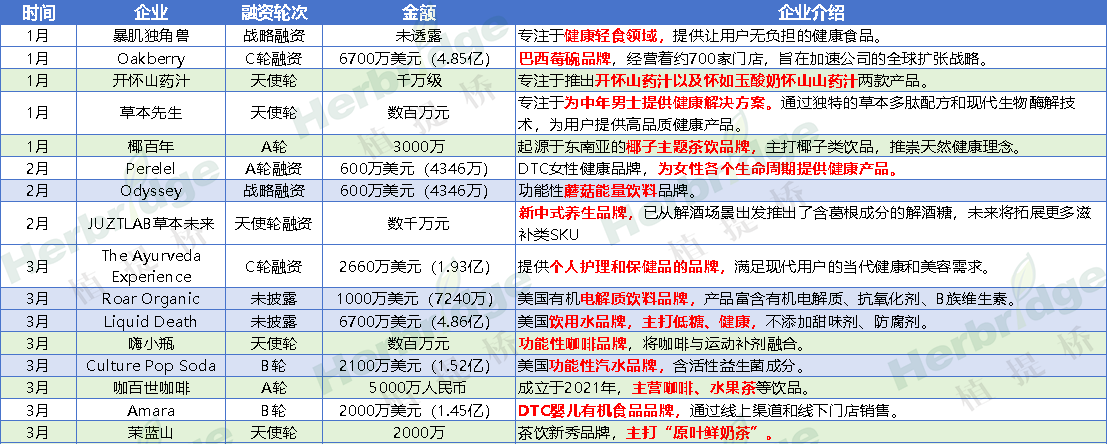

Nutrition and health industry Q1 2024 financing summary

Image source: Official account @ Zhitiqiao

From the perspective of financing trends, it is clear that technology-based companies are becoming the core area of capital injection. At the same time, the trend of financing in the health food and beverage industry shows obvious segmentation and specialization, and the health needs of the segmented population are gradually attracting the attention of capital.

Nutrition and health industry Q1 2024 financing summary

Image source: Official account @ Zhitiqiao

The strength of healthy drinks to attract gold is off the charts

On the downstream consumer side, the gold absorption strength of health drinks is particularly obvious, with more than half of the 16 financings in the domestic and foreign markets.

Foreign capital is optimistic about functional drinks

In foreign markets, functional drinks have been popular with capital. In the first quarter, there were four beverage financings, three of which focused on functionalization, including Odyssey, an organic hydrolyte drink brand, and Culture Pop Soda, an organic soda brand.

Energy drinks in the domestic market seem to be stuck on the traditional track, with most brands tending to use traditional ingredients such as taurine and caffeine in their formulations, and their health claims are mainly focused on providing energy supplements. When it comes to energy drink innovation, companies may start with formulations and broader health directions to attract the attention of consumers and capital.

The domestic market favors differentiated beverage brands

In stark contrast to the widespread attention to functional beverages abroad, the domestic market capital side is more inclined to beverage brands that use unique ingredients and have obvious differentiated positioning. Some of the brands that have successfully secured financing include the coconut centennial tea brand, which focuses on coconut, the Mo Lanshan brand, which focuses on raw leaf milk tea, and the Kaihuai yam juice brand, which focuses on the research and development of yam juice products.

The needs of segmented groups are being seen

In the current consumer market, capital is gradually recognizing the needs of different segments, such as adult men, adult women, and babies. Some brands, such as Mr. Herb, Perelel, Amara, The Ayurveda Experience, and others, have managed to attract the attention of investors and secure financing.

When examining the financing model of the nutrition and health industry, we can observe that the flow of funds presents a gradual transition from the raw material end to the consumption end. Specifically, upstream of the industry's supply chain, capital investment tends to focus on technological innovation, which reflects investors' emphasis on improving production efficiency and raw material quality. Downstream in the supply chain, the financing trend on the consumer side shows a focus on product diversity and target consumer segmentation. This change may indicate that the nutrition and health industry is undergoing a profound change from the surface to the inside.

In order to remain competitive in the future market competition, enterprises may need to pay more attention to the depth of investment in technology research and development. In addition, with the growing demand for personalized and customized products, companies should also consider how to provide differentiated products and services that meet the specific needs of different consumers. This transformation requires not only innovation at the technical level, but also breakthroughs in market strategy and product design to meet increasingly sophisticated market needs.